Four Steps to Deciphering Assortment Data

When scientists examine a specimen under a microscope, they can’t simply insert a sample and see immediate results. They must make adjustments until their focus becomes clear and they find what they’re looking for.

The same is true when it comes to retailers finding the right data and turning it into powerful insights. Simply having all the data at one’s fingertips is not enough to draw powerful, actionable insights; instead, retailers must focus on the correct data for a specific category or problem.

This is especially important for assortment planning. Accurate assortment planning requires a robust amount of historical data, but without taking a series of necessary steps to draw those insights and create actions, the assortments won’t address consumers’ needs.

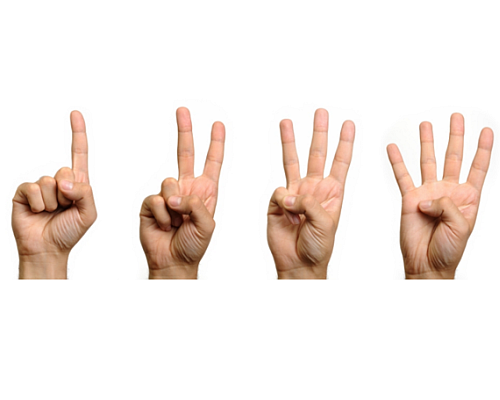

Below are four steps to focus on and draw conclusions from a particular sample of retail data.

STEP 1: Aggregate the historical data

Begin by evaluating a group of products based on a subset of product sales. There are unique selling patterns across the subset for each store, and that unique pattern represents a different customer mix.

Things to consider:

- Pick aggregate levels that have an appropriate signal-to-noise ratio. Pick a level with enough volume to be significant, yet low enough to provide meaningful aggregate levels. This will help retailers understand the "who" behind the demand in order to assort properly.

- Clean the data. Consider only looking at sales for those items that have not been marked down.

- Keep it simple. Don’t try to account for "lost business" due to inventory shortages.

- Consider how much historical data to use. An assortment curve for a given store may shift based on a shifting consumer base. Use the historical selling period that mirrors the floor set.

Step 2: Use analytics to group stores

With the aggregated data, use analytics to group stores based on the selling pattern.

Things to consider:

- Normalize the data. Store groups may be influenced by volume differences, so this is an important step.

- Be sensitive to the number of groups created. Make sure the number of groups are manageable and don’t exceed system limitations. Analytics should provide statistical break points to help guide the decision on the number of groups that are statistically significant.

- Understand that stores’ groups may overlap. Stores will drift to a final group as the assortment in the store represents true customer demand.

Step 3: Evaluate the results

Quantify the benefits of the improved distribution. Assume that the group pattern is representative of the true demand for the store and compare that true demand to actual inventory. Any delta between the inventory and the model-selling pattern might represent a missed opportunity.

Step 4: Tell the story

Analysts should help merchants understand the mix of customers each group represents.

Things to consider:

- Relate marketing personas that represent different customers visiting the stores to the assortment groups.

- Glean product preferences from the selling patterns in each assortment group.

- Use store demographics to help describe the customer types.

- Keep the story consistent each time the statistical grouping process runs. Groups should not be identical in everything other than the group name.

- Groups should be representative of the customer base that is shopping that particular store; this should be relatively stable and not change dramatically year-over-year.

- Realize that it is possible for a store to shift from one group to another due to significant changes in the store’s environment.

If retailers follow these steps, the likelihood of finding accurate insights in a sea of data greatly increases, ensuring that retail data scientists can find answers in sample data.

By Grant Graham, Principal, Columbus Consulting International