Data Sharing & Analytics Achievements: Future-Proofing Retail and CG Success

The rapid pace at which analytics are transforming both the retail and consumer goods space can feel like a race. However, while industry leaders speed toward new applications and models, it’s the companies that boast steady and consistent implementation, innovation, and growth that truly win out in the end.

Using CGT’s and RIS’ research as the backdrop for this insightful discussion, learn how brands are facing analytics challenges, jumping into unique initiatives, and determining which capabilities will help them accelerate their business. In this edited webinar transcript, discover how you stack up against today’s leading retail and consumer goods companies.

CGT’s and RIS’ Tim Denman and Lisa Johnston dig into the data of the annual “Retail and Consumer Goods Analytics Study” to discover which areas of analytics focus should be prioritized, the steps needed to adopt new technologies and platforms that support these efforts, and ultimately how to analyze insights to better inform strategies across the enterprise.

Tim Denman: Welcome to “The Race to Analytics Success” webinar, which is hosted by RIS and CGT and presented in partnership with Treasure Data. I'm Tim Denman, editor-in-chief of RIS and CGT. In the world of analytics, we know it's all about tomorrow. Retailers and consumer goods companies are laser-focused on leveraging analytics capabilities to predict future demand, drive decision-making, adjust operations, and much more. However, while focused on building the capabilities necessary to succeed today, retailers and CGs are facing some common challenges today that prevent them from fully executing future initiatives.

Today’s panel discussion will explore this idea, as well as how retailers and CGs are analytics-focused, some of their biggest challenges, where organizations are making investments, where they plan to invest in the very near future, roadblocks to analytics success, and some of the key analytics trends that you need to know now.

To explore these topics and more are Danica Konetski and Irene Sibaja both of Treasure Data, and CGT's Lisa Johnston. I'm excited to have this group of panelists with us today, why don't you each briefly introduce yourselves, and describe your respective roles?

Danica Konetski: Hi there, I am Danica Konetski, the industry principal for consumer packaged goods at Treasure Data. I've been here for about a year and a half. I previously had a similar role at IBM for about six years, as a global SME in consumer products, so I come out of industry. I was also at Kraft Foods twice and ConAgra Foods.

Irene Sibaja: My name is Irene Sibaja. I'm the retail industry principal at Treasure Data, and have about two months at Treasure Data under my belt. Before that, I was the retail SME and customer success lead for Sam's Club at NielsenIQ. I have more than 25 years of retail and strategy consulting under my belt. I spent 10 years at 7-Eleven, a couple years in the Walmart ecosystem, and I'm a customer-focused junkie in general. I'm excited to be here to have this conversation with you guys.

Lisa Johnston: Hi, everyone. I'm Lisa Johnston, the senior editor at CGT. I've been with the brand for about two and a half years, joining in January 2020. Before this, I spent about 15 years covering consumer technology and retail for another business media company. At CGT, I help lead the editorial coverage, as well as content initiatives for the CGT and RIS Executive Council, which we're very fortunate to have Danica be a member of.

Denman: This is certainly a powerhouse panel. Many of the topics we're going to discuss today are covered in RIS and CGT's annual "Retail and Consumer Goods Analytics Study" that was released ahead of the annual Analytics Unite event, which was held last month in Chicago. We're going to explore several key themes and findings from this benchmark research report here today. We certainly encourage anyone that's interested in a deeper dive into the topics or statistics to check out the full report.

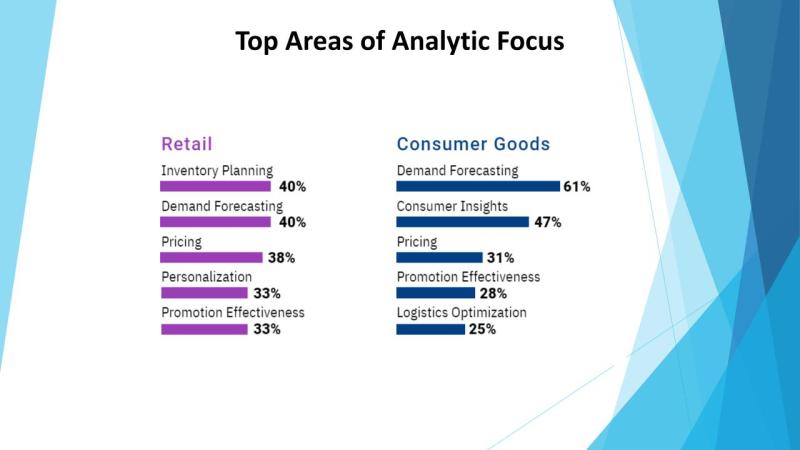

Throughout today’s discussion, Danica will provide insights from the CG perspective, Irene the retail angle, and Lisa some analysis from the findings of the study. One of the key pieces of this research is asking retailers and consumer goods executives for their current areas of analytic focus. Looking at the top responses, it's clear that the future is squarely on their minds with planning, forecasting, effectiveness, and optimization of various business functions, topping the list for both retailers and brands. Danica and Irene, when you're looking at these top areas of focus from the retail and CG perspective, does anything jump out at you? Any surprises?

Sibaja: From my perspective, yes and no. For retailers, the top two categories were inventory planning and demand forecasting, which go hand-in-hand. With the pandemic, over the past couple of years, retailers are struggling to have the right amount of product in-stock, to know how much product to pull through the supply chain, and then the supply chain has had its own set of woes. That's been top-of-mind for them. Yet, at the same time, when they think about how to move forward, there is all this data from the last two years that's not going to be especially useful as they think about going forward — that's where I say yes and no.

A couple of other points from the survey. Logistics didn't come up at all for the retailer, which is fascinating, given that distribution centers are all over the place and trying to get the right product into the right place for the right customers is a huge challenge for retailers. The second interesting piece that showed up on the CG side, but not on the retail side, is consumer insights. As far as I'm concerned, the whole initiative around personalization and promotional effectiveness is driven by what we know about consumers and their behavior. So, again, there you go, yes and no. Danica, how about you?

Konetski: In consumer goods, looking at the top five key areas of focus reflects what I'm seeing across the industry and in casual conversations that we have with clients. Four or five of these point to a shift from growth at all costs to a higher degree of emphasis on creating operational and marketing efficiencies — for instance, demand forecasting, logistics, and pricing and promotion. Consumer insights is number two on the list, but in terms of being surprised, I’m more surprised that it's less than 50% that placed it at the top of the list.

Similar to what Irene said, consumer insights can certainly drive meeting objectives on the other key areas of focus on this list, and then otherwise across the organization. For instance, more and more people are coming to us wanting to put data, analytic, and insight capabilities in place to maximize pricing and ensure that they are not deep discounting with promotions if it’s not needed. In one recent use case, someone needed to move unhealthy inventory around a product line with a niche target.

Using consumer data, the audience that lives for that unhealthy inventory was found, then sent a promotion to make them aware that the product is there to move it off the shelves without having to go into mass, deep discount to get it out of the door.

Similar to Irene, I’d say yes and no. All the things on the list make sense. We do see that move from growth to more focus on efficiency. While consumer insights is second, I was surprised it was under 50%.

Denman: Definitely. The consumer insight is interesting. To your point, Danica, almost everything on the retail side can be infused with those insights to do it correctly. It's an interesting point that they didn't call it out specifically, but they're certainly using it.

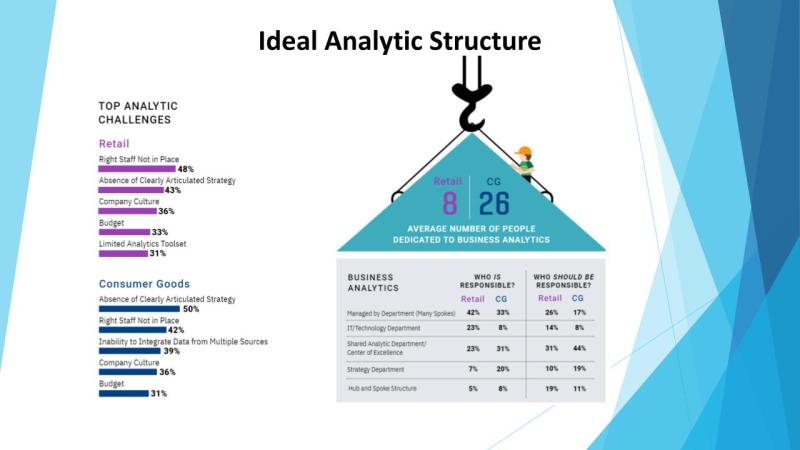

Another main theme of the report is that the transformative power of data and analytics is all but uncontested, right? No one's going to say, "You don't need data and analytics." However, that progress seems a bit hampered, not by technology, but by the internal infrastructure of retailers and CGs. Some of those challenges are outlined below. Top challenges for both CGs and retailers include staffing, which we're all well aware of, a lack of a clear strategy, company culture, and of course, budgeting concerns and issues.

Danica and Irene, do you agree with the idea that retailers and CGs' internal infrastructure are holding them back? If so, what can we do to improve that?

Konetski: I definitely agree. It is a key theme that came out in this study, as well as in studies we've done internally. There was a poll at Analytics Unite that made it clear the biggest impediment to growth in this area is, collectively across all these things in this slide, organizational readiness.

That would include a few things. One, because all of that is coming together at once, the proliferation of capabilities and demand. It's creating a sense of being overwhelmed and a sense of inertia and not knowing where to start. Even though it's uncontested, there's an underlying mindset of not being convinced of the need for dynamic change.

Sometimes people fall back on muscle memory and think, "I got this far doing it a certain way. That's worked for me. Why wouldn't I keep doing it that way?" There are all sorts of strategic things, but tactically, it's hard to make progress until we integrate all the data sources that we have into one place and put the analytic capabilities on top of that, the tools and so on, to make that accessible.

In terms of best practices, I've started thinking about it as this is best practice to progress — lean upward, meaning you have to constantly demonstrate the value of data and analytics. The best way to get that top-down support is through clear articulation of how this will help management meet business objectives.

As you're putting these capabilities in place, make sure you have a roadmap of use cases that are long-term, but also focus on quick wins to get traction and get people excited about these new capabilities quickly. Then, besides leaning upward, lean downward into your organization — we've talked about that a bit. When you have a vision of what you want to do with these capabilities, you have to plan your workforce, which could require upskilling or hiring new folks. As it relates to leaning downward in the organization, you can't underestimate the power of organizational change with these kinds of shifts, ways of working, and new processes.

A couple more tips and best practices. First, lean up, lean down — let me stay with that theme and say lean over, because you can use your ecosystem. You can use vendor partners to help speed up progress and carry some of that load. Then, lean in on innovation — the ability to work in an agile fashion and de-risk innovation. When all of those things come together, it can help break that inertia and get started. Take the first step, if you're feeling overwhelmed and don't know which big problem to tackle first.

Denman: Irene, which one would you recommend using?

Sibaja: Danica gave such a robust answer to that question, I'm not sure that there's a whole lot to add, because retail isn’t that different. I’ll point out where retail is different and where retail has a few more challenges. First, retail is everywhere, especially brick-and-mortars, locations are so just geographically dispersed that getting all of that information into a single place is a little more challenging than it is going to be for the CG companies.

In fact, this may be surprising, but the statistics show that there are many companies — almost half — that don't have the right kind of data platform to get all of the data into one place. Then, getting the data in one place and having it integrated, harmonized, and de-duplicated in a way that it's useful is the first step to overcoming that challenge. Yes, there are organizational and technological issues here.

The organizational issue that Danica brought up is the same for retail — the need for the leadership to have a clearly articulated vision around what we want data to do for us, what business problems we want it to solve, why those things are important, and then having that downward lean into the organization.

Denman: In this study, we see that retailers and CGs are talking about internal structure. They all agree that a center of excellence is the ideal structure, but less than one third of them operate that way. What are the roadblocks to adopting a center of excellence approach to your analytics?

Sibaja: This goes back to the idea of making sure all of the data is available to be aggregated and centralized in one place as the single biggest obstacle to having a center of excellence. There are a lot of organizational silos, especially in retail. You have support — the store support center, the corporate office, the ivory tower council, home office — in one place and all the functional areas that live inside of that. Then, there is a field organization that is either regional or functionally centralized. They're all doing data and analysis inside of their silos.

Often, in retail, there's this thought that things are done differently in certain regions, and what works over here isn't going to work over here. The questions we ask over here aren't the same ones, the answers are different. Getting organizational alignment around what the right questions are to ask and how to decentralize the process of getting the answers dispersed once you have this hub.

If you look at the results of the survey, the answers are more dispersed in terms of who should be responsible than where they are. Today, it is very much a spoke system, which is inefficient and goes here, here, here, here, here, rather than a direct, centralized organization — which isn’t quite the answer either. We need to get a central hub of data and then have folks in the field who are experts, either in the region or in the function, who can support and feed upwards that way. Danica, what do you think?

Konetski: A center of excellence makes sense if data and analytics is a specialized expertise and skill set. You want the folks who are doing that in your organization to have leadership that has the same domain expertise. If you don't have that, you run the danger of dumbing down the work. You don't have someone championing for the highest-quality work and the highest standard of work.

For that, there is wisdom in having a center of excellence, but where it breaks down is that you're disconnected from the business and don't have as strong a seat at the table. The best approach is that hub-and-spoke where your data scientists and insight professionals report into a center of excellence, but they're a dotted line and embedded into the business so that they fully understand the business issues and challenges — they have a greater seat at the table.

Denman: The key to an effective hub-and-spoke strategy is to make sure it's two-way — that it's self-served to get back to that center and pull out any information you need versus having it pushed out from the center to where it needs to be.

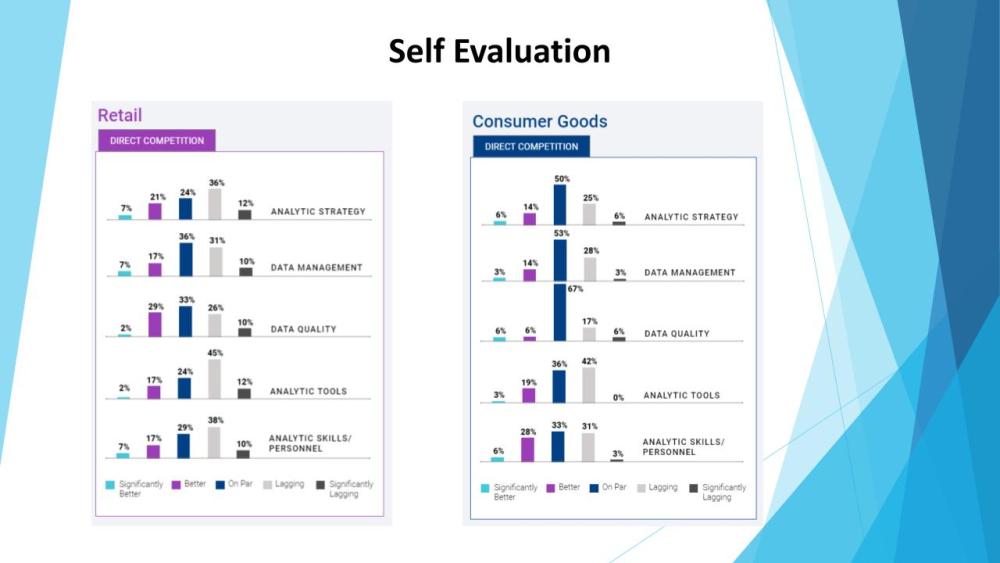

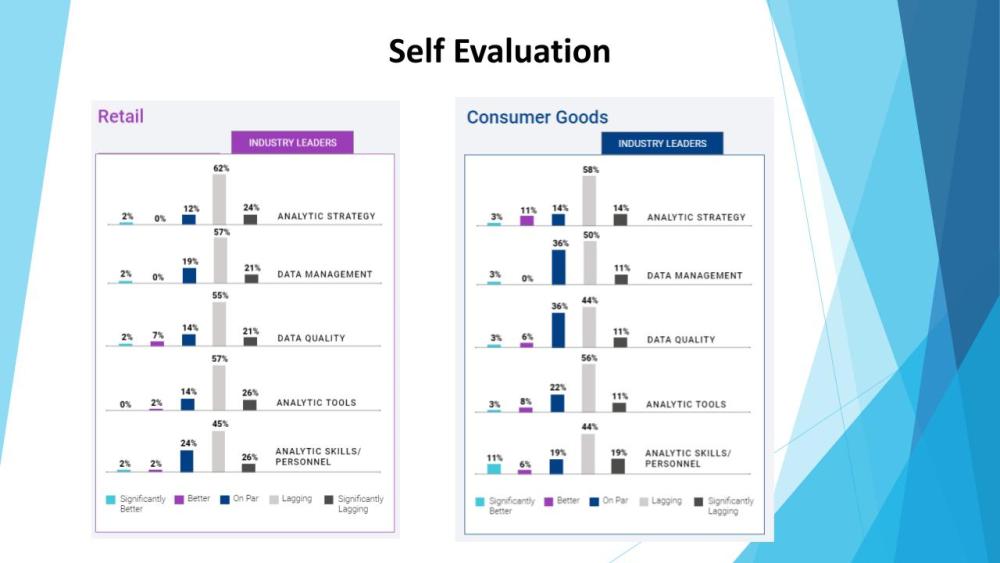

In this annual report, we ask retailers and consumer goods to evaluate their analytic strategy, data management, data quality, analytic tools, skills, personnel, etc. against direct competition as well as industry leaders. Examples of industry leaders on the retail side would be a Kroger or an Amazon, and on CG, we usually point to P&G or Unilever. Lisa, can you walk us through the retail and CG maturity self-evaluations, starting first with the direct competition and then touching on how they rank themselves against industry leaders? Any noteworthy statistics here?

Johnston: First, I loved listening to Danica and Irene bring this report to life with best practices and perspective, it's been great listening to that. As Tim mentioned, we asked retailers and CGs to rank their analytics capabilities against the direct competition and the leaders.

As you can see for retailers, when they're against direct competition, almost half rank themselves as lagging in analytics tools. They think their competitors have the technology, the solutions that are required to help them win and they don't. However, overall, they see themselves as being at least on par or better in most categories.

Things are a little better for CGs against their direct competition. They see themselves as being in line or better for data quality, data management, and analytic strategy, but things are a little less bright with the tools and personnel. When you think about personnel, that makes a lot of sense, given all of today's challenges in the labor market, recruiting and retaining tech talent.

In general, CGs give a more positive assessment against their direct competition. Moving toward ranking themselves against the industry leaders, things are a lot more dismal, especially for retailers. The majority say they're lagging or significantly lagging in all of the categories, and 83% say they're lagging or significantly lagging for analytics tools. About a quarter of them think they're significantly lagging the industry's leaders in all categories.

For CGs, again, when they go to the gold standards, things are a little better, not dramatically though. They see themselves most behind when it comes to the analytic strategy. Within the report, we asked them to rank analytics maturity — lagging, rudimentary, advanced, transformational — across 16 categories. Very few retailers or CGs consider themselves transformational, which isn’t surprising. In most categories, there were none that considered themselves transformational.

More retailers consider themselves lagging in more categories than CGs, they see themselves as being further behind than consumer goods companies. What's interesting is that 43% of retailers said they're lagging in consumer insights and personalization — that had the biggest gap. They seem to be aware that they're behind, but they need to prioritize it more with investments because it is crucial to getting ahead and meeting the needs of today's consumers.

CGs view themselves lagging with in-store analytics the most, which isn’t very surprising. Both groups saw themselves as middle of the pack, being rudimentary, in most categories. In general, both see a lot of room for improvement.

Denman: Lisa, you struck a nerve with these statistics, why is it that more retailers are saying they're behind than CGs? There's one thing of note, CGs have about three times the amount of internal analytics resources versus their retail counterparts. Does that play a factor into retailers viewing themselves as behind the leaders?

Konetski: This conversation came up at the conference. My first reaction is that CPG needs more staff because we never want to miss an opportunity to be of good use to retailers. We will do analytic work for them to the extent that we can, and work hard to bring those insights. Essentially, we can be that ecosystem that the retailers can use to do some of the heavy lifting and get some of that work done — not all of it, of course.

There was an interesting point, which was the notion that CPGs needed, historically, more data scientists, more effort in this area because we had less data. We had to rely on, not a census, if you will, but modeling and figuring out how to estimate based on the data that we have. There's two different nuances and points of view on that question.

Sibaja: Historically, retailers have had fewer resources inside of data and analytics for a couple of reasons. One, they tended to rely on the consumer goods companies to do that work for them, do that heavy lifting, as part of the cost of doing business. You want to put your product on our shelves, we're going to give you this data, and you do the analysis for us. The other reason is that retailers are leaner in this and retail margins are a lot lower than consumer goods margins are.

We can use this leverage when we have inventory to identify the right target customer, to get the right product to the customer who's willing to pay for it so that we don't have to sell everything at this distressed price and throw away a lot of product. From a retail perspective, a lot of this has to do with running very lean operations.

Denman: From a CG perspective, or from both CGs and retailers, if they know there's a gap and there's things that they're unable to do, tools that they need to acquire, what's stopping them from going out, buying it and implementing it? If they know they're behind, why not catch up?

Konetski: Great question. The demand is there, the capability is there, progress is slow, but why? There's so much demand, and frankly, so much low-hanging fruit that this is apparent paralysis almost. Not knowing how to start, where to start, or how to prioritize what to tackle first. Tie everything to business objectives, do nothing that does not serve the corporation's goals and business objectives, and then brainstorm all the use cases, all the ways that you can use data and analytics to further those objectives to empower data-driven decisioning in real-time.

If you tie the work to business objectives and have a long-range and short-term plan for how to bring in the capabilities and do what is minimally necessary at the beginning while you're developing your capabilities. You need to get the budget by demonstrating that value and get some quick-start wins to gain traction. It's a matter of having a plan, getting started, and being able to demonstrate value to get that top-down support in terms of resources and budget, and bottom-up support in terms of being excited about how all of this capability will serve them.

Sibaja: Also tap into the idea of the attention economy and a general sense of organizational ADD that we have. The question de jure seems to change on a regular basis and it takes a lot of discipline from a leadership perspective to stay focused on what key business objectives are because only then can you find the resources from both a financial and human perspective to get those questions answered.

Konetski: Sometimes with the bigger, multinational consumer goods companies there are still silos — there are a lot of brands and geographical silos. In that case, the budgets are often controlled in those regions. You have to do a lot of work to convince people to work together to create global efficiencies while staying locally effective. That's the fear. They don't want any global efficiency work to keep them from being locally effective, and I've seen that in a few cases.

Some of these companies have been around a long time, and maybe they've built a certain amount of capability in-house — it takes a minute to unpack all the things you've built and done to adopt new, modern approaches to doing things. There are still barriers around silos, a resistance to integrating data in the service to everybody, and also unpacking the way they've done things for 50-100 years.

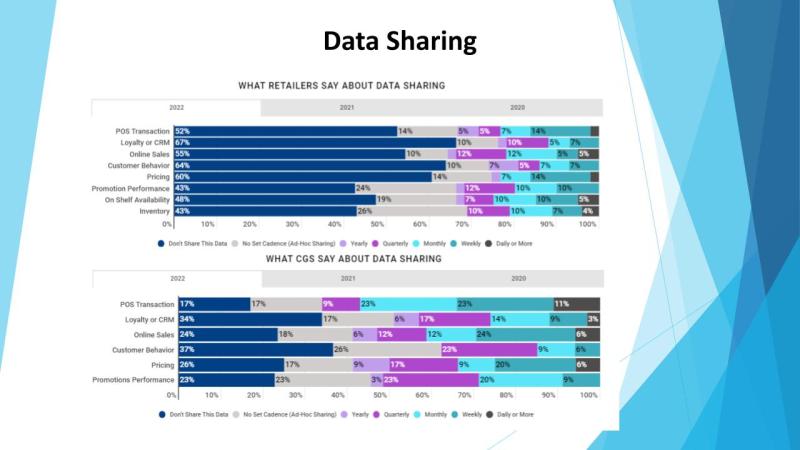

Denman: A big piece of this study has been, over the years, the concept of data sharing. We started this study about 8-9 years ago as the “Data Sharing Study.” It's always been a slippery slope when it comes to retailers and CGs.

Our retailers, traditionally, have been more reluctant to provide brands with all the data they need to successfully track trends. It's an understandable tight rope that they walk for retailers, from providing partners with all the data and insights they desire, and holding back the data that they view as proprietary. Lisa, can you look at this data for the last few years? RIS has been benchmarking it beyond three years, but we have three years of data here. How has the data-sharing data evolved over this time?

Johnston: Data sharing is something that retailers and CGs may never come to agreement on. Anecdotally, we have heard, especially during the pandemic, that there was more collaboration going on.

However, when we surveyed the audience, the one thing that hasn't changed is that both sides of the fence say there still isn't a lot of sharing occurring. Nearly half of CGs, 46%, say retailers aren't sharing data or are only sharing on an ad-hoc basis for all types of data. Last year, it was 48%. There’s been a little progress, but not much.

When we look back at three years of data, POS data is still the most common type of data that's being shared with some regular cadence. Consumer behavior data is still the least likely to be shared. Retailers say consumer behavior data is among the least likely type of data they share with suppliers on a regular basis, while POS data was the most likely for the last two years.

As we mentioned, this topic came up at Analytics Unite, and it was interesting. At one point, there was one retailer who was surprised that CGs didn't have the same amount of data or the same quality of data that retailers have access to. This was a retailer saying she just didn't know that CGs didn't have access to this — there's clearly a lot of work that needs to be done.

What is different is that the number of retailers charging for this data has gone down significantly from the past two years. More than half of CGs say retailers aren't charging them for data, which is more than double the results from 2020 and also 2021. If you ask the retailers, they haven't changed anything because they've always said they don't charge for data. All three years, between 73% and 82% have said they don't charge for data. Again, it depends who you're asking on how things are changing, but when we return to this next year, it will be interesting to see if there's any more clarity.

Sibaja: Lisa, a comment on the monetization piece. It's actually been my experience, specifically inside the grocery channel, that there is an increase in data monetization. We're seeing more retailers selling different kinds of data than ever before — Kroger, Albertsons, Walmart with their new Luminate platform, and Sam's Club with their MADRID platform.

Johnston: Next year, we'll likely have to change our definitions of how we classify how they charge for data with the rise of retail media networks. It will make sense, next year, to reexamine how we're defining this because it has changed so much since this study was first started — we might not be able to do an apples-to-apples comparison next year because it might not make sense anymore.

Sibaja: The media is a good component to bring in here. One of the arguments is that suppliers, yes, make more than retailers do. However, they have a limited amount of money, a bucket of money, set aside to support retailers, whether it's media spend, data spend, cost of goods reduction, trade spend, or shopper marketing. For some reason, there's a perception on the retail side that they can just keep going to the well and the well's going to get deeper.

It's going to be interesting to see at what point the CGs push back and say, "the cost of goods is going to go up and you're going to have to raise your prices," or something's going to have to give. It's going to be a very interesting conversation between the retailers and suppliers to see how that plays out.

Konetski: To the extent that data sharing is an issue, and you combine that with the deprecation of cookies, people turning off ad blockers and location services, etc. it speaks more collectively to the need to have a first-party data strategy in CGs.

The other point is that it's no different from someone selling to an end user and needing personal information. People will share with you — a company, a brand, or retailer — their personal information to the extent that they get value back. That is true in this relationship as well. If you are asking for the data, you need to be prepared to give that value back. If you do, they're more willing to share the data, even in a context where data is currency and a competitive advantage.

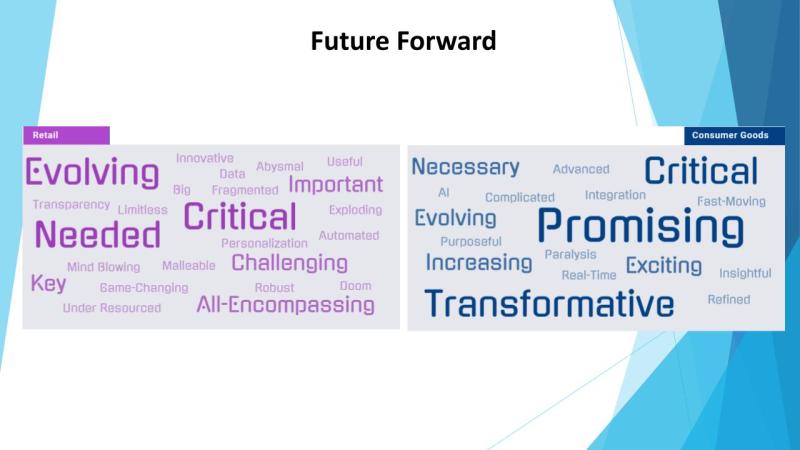

Denman: This was a word cloud that we came up with — one for retail, one for CG. We asked everyone to give us one word that they thought about for the future of analytics. You see a dichotomy here between hopefulness and concern in both word clouds.

Can you provide an example of a company that's been successful or made progress in breaking down the organizational silos that are preventing full analytic access?

Konetski: One great example that we can share is Anheuser-Busch. The company, as some may know, is very zone-oriented, with a North America zone, across the globe, and those zones are very empowered. We were able to put a customer data platform in place for them — it's 500 brands, 40 countries, 700 systems.

In four months, we brought all of their consumer data together in one place to keep it secure and private, to harness all those profiles and make those profiles as robust as possible because they were sharing data after it was harmonized and de-duped. We manage more than 70 million identities for them.

It's noteworthy, not just because of the size and robustness of that job, but also because they are zone-oriented. A primary driver of the top-down influence to make that happen was security, privacy, and minimizing the reputational and financial risk of having all consumer data far-flung across the world. There are a lot of good, sound motivators, but that one certainly makes sure that you are compliant and treating customer data respectfully. The great news for us, when we do that, is that we become more aware, have more insights about consumers, and can begin to engage with them in a way that is relevant and personal to them.

It’s a great example of how they were able to and why they broke down the silos. Now, the marketing and operational use cases are flowing because they have all of that together.

Sibaja: AB is such a great example. Even inside of all of the locations, there are bottlers, franchise organizations, and there's cultural implications. When you talk about, is it possible inside of a complex organization to do this? Well, yes, it's possible.

Denman: Lisa mentioned the growing retail media networks, earlier. Irene, how do you think the retail media networks fit in, or will fit in, to the broader landscape of data sharing with the new services-oriented models and creative collaboratively?

Sibaja: The retail media is producing yet another source of data input on how consumers are behaving, where they're going, and how they're buying. It's another input into getting this complex picture of who the shopper is. That's how the data is going to play out. From a data sharing perspective, the retailers who are selling the media, the consumer companies get that data. They get specific information about consumers so they can leverage that.

Denman: How do you think retail media networks fit in, or will fit in, in the broader retail landscape of data sharing, which you addressed? The second part of the question is, with new services-oriented models and creative collaboration.

Sibaja: The insights that come out of the media, particularly inside some of the social listening that we now have available at our fingertips, will allow retailers and CG companies to drive innovation in new and interesting ways. We're already seeing some of that. Danica, what do you think on the services collaboration side?

Konetski: The consumer is the common ground between retailers and CPGs — we are sharing the same consumers, have the same objectives with them, and it simply makes sense to collaborate to provide the best experience for that consumer. It's a good thing to do — we're all keeping the consumer and shopper at the center — working together to drive great experiences for them is important.

Sibaja: I'm thinking about companies like Nike and Coca-Cola. The Coca-Cola Lounge we saw recently is a great example of that. Nike and all the ways it’s personalizing the experience based on how folks are interacting on social media or what's popping on social media, from TikTok, Facebook, YouTube, even Instagram. There are tons of self, user-generated content around what they like. That gives the CG companies a direct plug-in into ideas around innovation, what's hot, and how to get there.

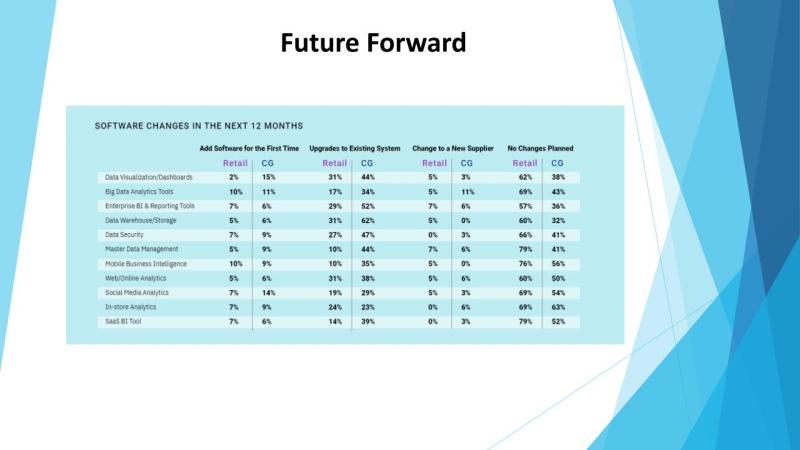

Denman: Here, you'll see some of the major software upgrades that retailers and CGs are planning for the next year to improve analytic success and prowess. Danica and Irene, what is standing in the way of analytic progress? We touched on this a bit — a lot of budgeting concerns, things like that. What do retailers and brands need to do and what technology, specifically, should they be embracing to ensure analytic capabilities become a differentiator for them?

Konetski: We know CPG has big plans to upgrade. We know that they have plans to invest in storage, computing, and visualization tools so that people can tell a story, as well as tools that allow people to easily discover, find, and activate against insights. We see all of this increase in investment, and the category of customer data platform has increased 20% over each of the last two years.

My domain expertise has always been in consumer and shopper insights, so I have a point-of-view that if the consumer and shopper are at the center, if they are the North Star (and we all agree that they are), then it makes sense to have the consumer at the heart of your tech stack, and your operational and go-to-market plans. Do what everybody knows.

The value of doing that is uncontested, but to bring that data together, integrate it, harmonize it, and the people who reach the goals that they have set out for themselves in this way, will have done that. They will have integrated and harmonized their data, put predictive analytics and machine learning on top of that data to segment and understand their portfolio of strategically important consumers, and know how to interact with them in the most meaningful way.

You also need the tools to make those insights discoverable and actionable to guide the decisions, and then put all the organizational changes in place and empower your people. Serve those insights up, make them easily accessible, and use visualization tools to help them tell a story and make decisions in real-time. Do it with confidence because they have all of that foundation in place.

Sibaja: I was disappointed in the difference in how few retailers said that they had investment plans going forward compared to CG. The reasons why retailers are not investing is worth discussing and investigating at a later date when there's more time, but it's a sad contrast to me on that topic. I hate to end on a negative note, but retailers, you need to get on the ball with this. This is very important.

Denman: Well, thank you to everyone on the panel for a great collaboration, a great conversation. For now, I thank the panelists, everyone for joining, and Treasure Data for their partnership and support.

This article first appeared on the site of sister publication CGT.