Future Retail: Where Do We Go From Here?

E-commerce sales are soaring, but when a level of normalcy returns to the retail industry, what is the future of the physical retail environment?

To answer this, Sucharita Kodali, VP, principal analyst at market research and consulting firm Forrester, explored the current state of the store and provided vision for the short- and long-term future for retail during Analytics Unite on Wednesday, Oct. 7. (Nestle CIO Filippo Catalano and chief data and analytics officer Fancesco Marzoni kicked off the event.)

In her keynote presentation, “Future Retail: Where Do We Go From Here?,” Kodali gave an insightful overview of retail trends relevant to both retail and brand professionals, citing data from various Forrester and third-party resources throughout.

Kodali kicked off by discussing where we are in recovery from COVID-19, noting that we are in the management phase, and that Forrester expects that retail sales will be lower than expected by a modest degree even in a worst case going forward. However, four sectors have done better than everyone else: pure-play e-commerce, grocery, home improvement and general merchandise. What this means for e-commerce is that online retail is expected to perform better than expected even in a worst-case scenario.

“Whatever the physical store has lost, the e-commerce channel has gained, and you have that gain continuing well into the future,” Kodali noted.

She explained how the best way to help salvage store traffic is to layer on the safety precautions, including investing in technology solutions such as UV-C lights, electrostatic disinfectants and ventilation solutions.

E-commerce success

Speaking about online retail, Kodali reviewed data on marketplaces, noting that most retailers can be highly competitive here with respect to the “quality and assurances of what they provide.” Almost 20% of U.S. consumers worry that products on marketplaces are poor quality or counterfeit. Price is a key driver of marketplace success.

“I would love to see brands and retailers embrace a retail version of Kelly Blue Book” for online merchandise, said Kodali.

She noted a great direct-to-consumer (DTC) site is a strong alternative, but data is key to DTC and staving off marketplaces. A number of third-parties are helping brands and retailers capture data in different places to help them make better business decisions.

But Kodali clarified that this isn’t about mining personal consumer data and information.

“I think that’s often one of the biggest areas of myth really in retail, is that you just need every bit of consumer information you can exploit because that’s the key to everybody’s success. … I don’t think it’s the key to most retailer’s success stories.”

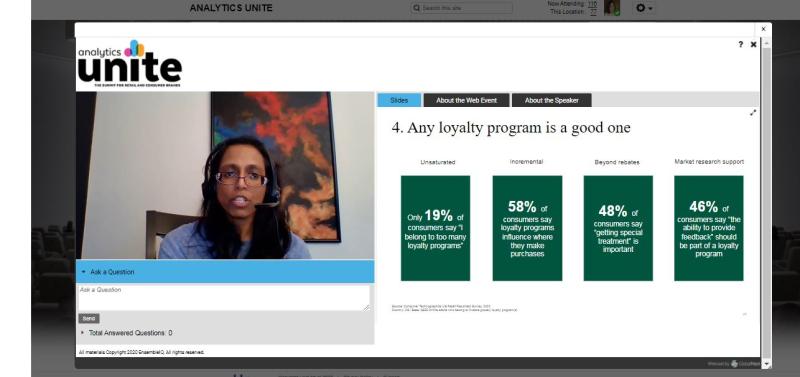

Resources and alignment instead are essential to data success, she said. Organizational structure, such as having the data person report to the CEO directly, is important. From a consumer data standpoint, she warned, “just use the data that is the minimal amount that you need, even for marketing.” Purchase history, shipping purchases and loyalty programs are the most useful for retailers. A loyalty program, even for brands, can be great, she noted.

“As much as people belong to 20 loyalty programs, there is still opportunity for more.”

She pointed to research that 46% of consumers say “the ability to provide feedback” should be part of a loyalty program. Not only can businesses do this to reduce some market research expenses, they can get their best consumers to volunteer information on how to improve the company.

“It’s shocking to me that every company doesn’t do more of that,” she said.

To wrap up the keynote, Kodali offered retailers and brands recommendations. To hear the full presentation and get her expert recommendations, visit AnalyticsUnite.com.

Kodali can be reached at [email protected] and on Twitter at @smulpuru.

.jpg?itok=8xtYIXSJ)